Rx Corner

Learn more about all things Pharmacy!

The Rebate Maze Part 2: How to Actually Compare PBM Contracts

In Part 1 of addressing rebates (which can be found here: The Rebate Maze Part 1 ), I tried to lay a foundation for understanding the function and flow of rebates. I emphasized the importance of contract guarantees and in particular, minimum rebate guarantees with a PBM. However, addressing minimum contract guarantees is easier said than done and there is a pernicious web of terms that many consultants do not understand or have the ability to evaluate. In this piece, I’ll address the critical items a consultant needs to be mindful of when evaluating rebate guarantees in a contract: Definitions and Inclusions/Exclusions

A Word On Philosophy

Many PBM solutions fall into two rebate philosophies: “I’m the biggest and have the best pricing” or “I’m pass-through and pass 100% of my rebates through”. More often the larger PBMs fall into the first camp and the smaller PBMs fall into the second camp. As addressed in Part 1, however, other components such as clinical independence, clinical programming, service quality, relationship, and prior history should be taken into account. The comparison mechanism I am outlining addresses only one component of the evaluation, pricing, and this methodology works extremely well when comparing PBMs within the same philosophical camp. When comparing PBMs across philosophies, the other points of differentiation become much heavier and you will need to expand on your knowledge of patient experience, NPS scores, clinical management, and clinical programming to compare across philosophies. In a grocery store parallel: It’s easier to compare Wegmans Vs. Publix or Trader Joe’s or to compare Wal-Mart Vs. Aldi’s than it is to compare Trader Joe’ to Wal-Mart. These are serving completely different psychographic populations with vastly different buyer preferences. The first step in running an RFP is discovering which philosophical camp your client aligns with and making that the focus of your RFP.

Rebate Channels and Basic Rebate Algebra

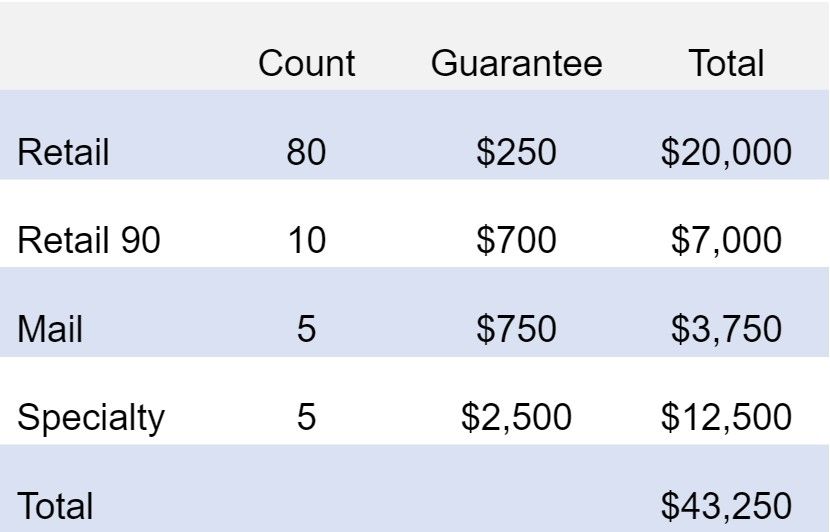

I addressed the pass-through contract in Part 1. When looking at channel-level guarantees a PBM will typically break down their guarantees into Retail Brand, Retail 90 Brand, Mail Brand, and Specialty Brand Rebate Guarantees. The simple math is to multiply the number of claims in each channel by the guarantees to get a projected rebate guarantee:

If it was really that easy, you wouldn’t be reading this article.

Rebate Calculus and Shell Games

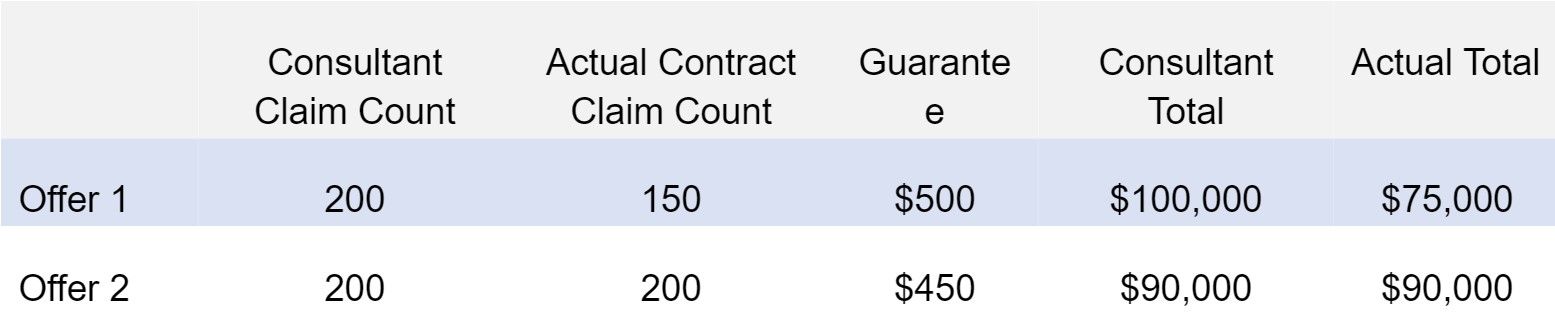

There are a lot of “games” inside of a pharmacy contract and consultants often have trouble combing through the weeds. The most important thing you can understand is that a PBM doesn’t win business if they have the best offer. They win business if you THINK they have the best offer. And while many people get mad at PBM’s over this – they didn’t contrive the industry as a grand master plan and its the inability of most consultants to properly compare them that forces them to play these shell games. I think of rebate manipulation as a division equation where the PBM’s strongest tactic is to manipulate the denominator. There is a total amount the PBM is willing to guarantee you in rebates – that is the numerator. Then there is the number of claims that are filled as the denominator. For the PBM to win, they need to have the highest quotient. Note, this is philosophically backward. You actually care about the Numerator. You are working backward from the quotient and denominator to arrive at the numerator. For example, if they were to offer $100,000 in rebates over 200 claims, that is $500 per claim in rebate guarantees. If someone else is willing to offer $90,000, that is $450 per claim. The $100,000/$500 per claim offer wins.

However, if a PBM knows the consultant is just taking all brand claims into account, and they can exclude a subset of 50 claims from their guarantees – the consultant will do the same math equation even though the PBM is only paying the rebate on 150 claims. Now, the PBM is offering a $500 guarantee over 150 claims for $75,000 in rebates but because the consultant is calculating it wrong and assuming it is over 200 claims the wrong PBM will win this RFP. See below as an example:

If you think this is annoying – imagine being the PBM salesperson for Offer 2. This is what makes accounting for as many rebate exclusions critical to doing an evaluation.

Common High-Impact Exclusions

Vaccines: Vaccines are excluded from virtually every rebate agreement. And let me tell you – covid really screwed up rebate projections because Vaccines typically process as brand claims. Many consultants multiplied their vaccine claims and included them as rebate-eligible claims. Big miss.

OTC: Over-the-counter medications like Pepcid, Nexium, Iron Pills, Prenatal Vitamins, etc. are often excluded from rebate contracts as well. However, there are some important caveats to this.

Diabetic OTC: Some claims for diabetes process as OTC claims but can be included in rebate guarantees. These include diabetic test strips and syringes and some older forms of insulin. This can be either included or excluded in a contract they can impact pricing significantly.

Limited Distribution Drugs: These are claims that the PBM has determined are from a limited subset of pharmacies and they may place a blanket exclusion. Again, the term varies wildly and can have a significant impact on pricing. You can find our article on this here:

The Bermuda Triangle of Exclusions: DAW 1 & 2, Formulary Exceptions and Multi-Source Brand exclusions are 3 ways to exclude a subset of similar drugs. DAW 1 & 2 claims are claims where either the patient or provider requested a brand medication over a generic. Think of filling Lipitor instead of atorvastatin. Multi-Source brands are a similar class of drugs, they are brands where there is another manufacturer of the medication (either a branded generic or generic medication). Finally, formulary exceptions are addressed both here and separately. Formulary exceptions are medications that are excluded from a PBM’s formulary but are approved because either the plan or a provider requested a formulary exception for medical necessity. Many times Multi-Source brands are excluded from a PBM’s formulary. Hence a PBM may say that they include DAW 1 & 2 claims, and they include Multi-Source brands – but ultimately they will avoid paying the claim because they are excluding a drug approved by formulary exception. Three different ways of targeting the same subset of drugs.

Formulary Exceptions 2.0: Formulary Exceptions are very difficult – because you cannot actually proactively calculate these exclusions, whereas it is entirely possible on the aforementioned exclusions. The reality is, that you do not know if a drug that is excluded will transition to a formulary drug or if a patient will be allowed to stay on their medication. This is particularly challenging in the specialty arena where patient biology is so nuanced it can’t be predicted whether or not a formulary drug will have the same effect. And providers will often request an exception due to continuity of care from a PBM. Here’s where it gets very complex – the PBM now has a massive incentive to APPROVE that provider request because they will NOT have to pay your client a rebate on the drug, even though they will certainly still receive one from the manufacturer. This is because they will receive a smaller rebate than had the patient used the preferred formulary medication.

HIV/Antiviral Claims: Some PBMs may exclude HIV or antiviral claims from rebate guarantees. This is high variability and high impact.

340B Claims: This is a near-universal exclusion. However, like Formulary Exceptions, it is not something you can proactively calculate. You do need to request a tight definition of what a 340B drug is as some PBMs have abused this language to classify all medications prescribed out of certain pharmacies as excluded – regardless of whether or not they were actually 340B claims.

PCSK9 Claims: These are claims such as Repatha and Praluent, also sometimes referred to as “Super Statins”.

Migraine Medications: These often refer to CGRP inhibitors such as Emgality, Aimoig, AJovy, and Nurtec (thanks Kardashians). These can vary by PBM and are less common but can have a significant impact because when they are excluded they are often found on a PBM’s specialty list.

Rebate Definitions

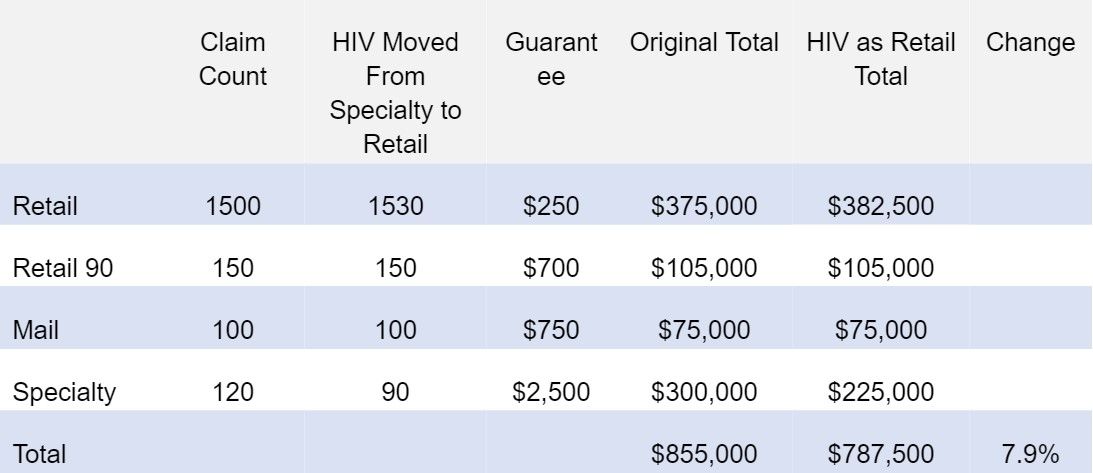

The second way that a rebate equation gets manipulated is by changing definitions. The two most common definition variances are in Limited Distribution Drugs and Specialty Drugs. Whether or not a PBM defines a drug as specialty is critical, as specialty rebate guarantees are often 10X of a retail guarantee. If a PBM can move drug A from specialty to retail, without you knowing it – they can win the spreadsheet game. Below is an example:

This is a very realistic example. 30 HIV claims could be just 2 or 3 HIV patients and can change the rebate projection by almost 8%. In some industries, HIV utilization is so high that it can move the needle 30%-40% in rebate projections just be how it is defined.

Rebate Statistics and Probability

We’ve moved from the concept of Rebate Algebra, to Rebate Calculus – but I want to encourage you to think of rebates more as a probability distribution. A clients utilization is going to change from year to year, and as discussed – there are some exclusions like formulary exceptions and 340B exclusions that you cannot really evaluate. The smaller the client – the more volatility you will see. One specialty patient can swing the rebates 15-20% for some smaller employers. You do not want to hang your hat on a specific rebate number with a client but help them understand that you are controlling for as many variables as is possible when developing your expected rebate projection for a given contract and that your relative comparison between PBM’s should be the main focus. The difference between PBM’s of your projected rebates should hold fairly constant with changing utilization and hence, should be the primary concern – less than the specific rebate number you are projecting.

If you are looking for a technology platform to help you create these projections in a matter of seconds not hours, to monitor your PBM’s performance and to scale it over your organization – that is exactly what we do at RingmasterRx and please feel free to direct message me on LinkedIn or contact us through our website at www.Ringmastertech.com.

Written by Jason Wenzke

President, Ringmaster Rx

Ringmaster Technologies